Proud Associate Member

GROWTH THROUGH PARTNERSHIP

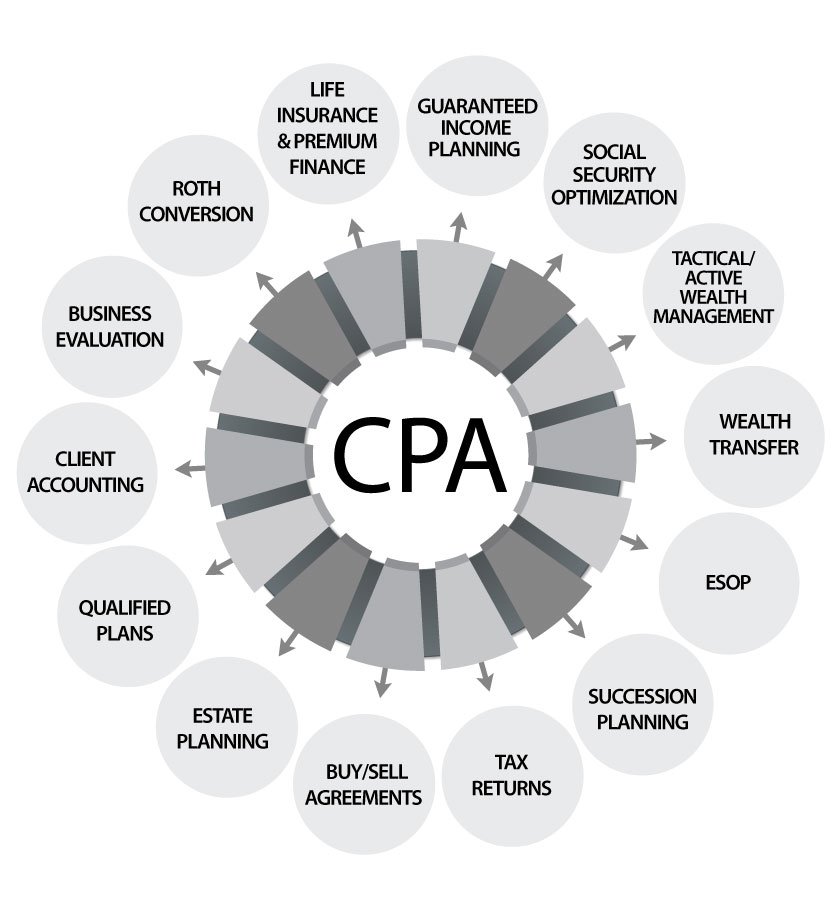

Opportunities for CPAs and Their Clients by Offering Financial Fiduciary Advice

As A CPA You know better than anyone else that to remain profitable, you must consistently develop fresh sources of growth and income. If you are looking to expand your practice by providing an integrated approach, tax strategies, and financial planning, our CPA Joint Venture program is the fit for you. We want to build a sustainable relationship with you, one that will last for the long term. We have created joint venture options to fit your needs, and your business.

What is CPA Joint Venture?

CPA Joint Venture was Founded by an Experienced CPA, Attorney and Registered Investment Advisor. CPA Joint Venture Helps CPA’s provide more value to their existing client base through Organic growth with unbiased Financial, Insurance, Estate & Tax Solutions designed by SEC Registered Investment Advisor Representatives, CFP’s, CPA’s & Tax, Estate and Business Attorney’s. Think of the CPA Joint Venture Team as your back office that helps you become your clients most trusted advisor.

CPA Joint Venture’s Mission Statement

Our Mission at CPA Joint Venture is to build relationships of trust with our CPA Partners and provide their clients with accurate, comprehensive planning and personalized wealth management strategies to help them gain financial independence throughout retirement.

Our Proprietary Retire Well Blueprint© Puts everything in an easy to understand step by step process.

Our Team’s combination of knowledge & experience, licenses, registrations, and special education qualify us to work with all types of investments. Our process takes a comprehensive approach to planning that incorporates your clients Investments, insurance, legal and tax planning. We work behind the scenes supporting you in order to add value for your clients and become the most trusted advisor. These strategies are designed to help Professionals, Business Owners & High Net Worth Clients.

Investment Planning to Decrease Risk & Volatility

Proactive & Comprehensive Tax Planning

Insurance Planning

Estate Planning to help Efficiently Transfer Assets in the Most Tax Efficient Manner

Our Retire Well Blueprint© Plan

Estate & Special Needs Planning

Income Planning That Can Be Guaranteed for Both Spouses Lives

Planning In case of One of the Spouses Passing

Long Term Care Planning

Solutions for Your Clients

CPA Client Typical Interactions

Click to Enlarge

In todays world a CPA typically will provide Tax & Accounting advice however clients typically will ask for advice about their Social Security, 401k, IRA and other Investments, Life Insurance, Estate Planning, Roth Conversions and Business Related matters such as Buy/Sell Agreements, Exit Planning and Business Evaluations.

This puts a strain on resources and there is a long learning curve to become proficient at the non-core Financial, Insurance & Business Planning offerings.

CPA Joint Venture & CPA Interactions

Click to Enlarge

When you work with CPA Joint Venture you will be partnering with an experienced team who shares a fiduciary responsibility along with similar values and work ethics.

This relationship will allow you, the CPA to be the lead advisor and offer additional value to your clients without allocating your existing office staff or personal research. CPA Joint Venture also provides all supporting CPA branded compliant marketing material.

That allows you to stay focused on your core business, increase revenue organically and provide additional benefits for your clients.

How To Join Our Network

Fiduciary Standard – Managing The Expectations of Consumers

REGISTERED REPRESENTATIVE

Stockbroker | Suitability Standard

Registered representatives have an obligation to deal fairly, honestly, and openly with their customers. If they do not, they can be liable for a variety of offenses. NYSE Rule 405 and NASO require that representatives recommend suitable investments for their customers, though these recommendations may not be the best recommendations. The requirement to provide only suitable investments might make it appear that registered representatives have a fiduciary responsibility to their customers, when, in fact, they do not.

INVESTMENT ADVISOR REPRESENTATIVES

Financial Planner | Fiduciary Standard

The SEC has taken the position that investment advisor representatives, unlike registered representatives, have a fiduciary relationship with their customers, which implies a higher standard of care than what is required of registered representatives. The implication for investment advisor representatives is that if their advice does not meet a fiduciary standard of care, they are vulnerable to litigation. When an investment advisor representative gives investment advice or makes investment decisions on behalf of a customer, the advisor is held to a higher standard that is based not only on caution but also one experience, and their commitment to a prudent investment process.